Another short post. It's 10:14 and I'm ready for bed.

I remember my Dad, a few years ago, telling me: "Politics is great fun to watch. Every bit as exciting as football. And it just keeps playing," or words to that effect. And now I am a True Believer!

Watched cuts that amounted to most of the President's press conference. Have checked a bunch of blogs. Most people, even progressives, still have no idea what the President's going to do. Some say he's made up his mind that without revenue increases in the mix, he won't take the deal. Others say he will compromise at the last minute as he did on taxes before Christmas. One or two think he has given up on negotiations.

Conservatives are still certain he will fold his tent and agree to a deal without tax increases, but one of the problems with most of this group is they don't believe there would be real consequences from default.

The Dow had a good day, after the news from Greece. Bond yields are inching up, but no sign of panic. No one seems to think there is much chance of default. I don't think we'll default, because I think Treasury will keep writing checks. Since last night's post, I've discovered the 14th Amendment prohibits the US from not paying its debts, so there is another legal defense for my theory of John Wayne Obama at the OK Corral.

My forecast is the same as last night:

Obama will not fold on the revenue question.

Republicans will be pressed, but won't budge either.

We will go into the Abyss, or so we will think. The bills will keep being paid to our creditors, and Republicans will have supported the cliff-jumping without any rescue plan.

If they are smart, which I sincerely doubt, they will immediately say they knew this was the game all along. If they are angry and not composed, they will blast the President for malfeasance and thereby directly condemn themselves. Obama had a parachute for all of us. They did not. The plan was to wreck the economy and thereby ruin Obama's 2012 reelection chances.

On August 3-4, Republicans will need to be very light on their feet, and quick to share a laugh with the President. Either way, the President wins.

Wednesday, June 29, 2011

Tuesday, June 28, 2011

A Little More on the Debt Ceiling Fight

A short post. Heading to bed.

Kabul got the news cycle this evening, so not much on TV news about the debt fight. Lots of blog activity. Tentative conclusions from my vantage point:

1. Republicans are convinced the President will cave. Many, possibly most Democrats are as well. Conservative Marc Thiessen wrote in yesterday's Washington Post that the President cannot let the country go into default, so the Republicans hold all the cards. Democrats worry that Obama is too much of a peacemaker, that he wants peace not war, and that he will not insist on revenue increases.

2. The newest twist from John Kyl today in the Senate is that Republicans just won't vote on the debt ceiling, letting the Democrats, at least in the Senate, pass it, and then pound them in coming elections for voting to increase debt without appropriate cuts.

3. Nevertheless, I conclude that Obama will not cave, that revenues will be in the agreement, or no deal. Republicans will be pressured by Wall Street to add revenues. They will refuse. We will approach August 2 with everyone staring at the abyss. And on August 2 or 3, Obama will order Treasury to keep writing checks to bondholders. Republicans will be apoplectic, and might even move towards impeachment. Obama will respond that, as President, his duty is to protect the country, and he will continue to do that and follow his chosen course until agreement on a fair deal is reached. I like Obama's odds in this fight. The lone cowboy, defending his people against a gang of attacking thieves.

The true odds of something like this happening - one in ten. But it's not impossible. Republicans are playing a dangerous game, and I think they have not learned the rules of all great generals: Never disrespect your adversary. Know him better than you know yourself. Republicans have not done this. They have little or no idea who our President really is.

Kabul got the news cycle this evening, so not much on TV news about the debt fight. Lots of blog activity. Tentative conclusions from my vantage point:

1. Republicans are convinced the President will cave. Many, possibly most Democrats are as well. Conservative Marc Thiessen wrote in yesterday's Washington Post that the President cannot let the country go into default, so the Republicans hold all the cards. Democrats worry that Obama is too much of a peacemaker, that he wants peace not war, and that he will not insist on revenue increases.

2. The newest twist from John Kyl today in the Senate is that Republicans just won't vote on the debt ceiling, letting the Democrats, at least in the Senate, pass it, and then pound them in coming elections for voting to increase debt without appropriate cuts.

3. Nevertheless, I conclude that Obama will not cave, that revenues will be in the agreement, or no deal. Republicans will be pressured by Wall Street to add revenues. They will refuse. We will approach August 2 with everyone staring at the abyss. And on August 2 or 3, Obama will order Treasury to keep writing checks to bondholders. Republicans will be apoplectic, and might even move towards impeachment. Obama will respond that, as President, his duty is to protect the country, and he will continue to do that and follow his chosen course until agreement on a fair deal is reached. I like Obama's odds in this fight. The lone cowboy, defending his people against a gang of attacking thieves.

The true odds of something like this happening - one in ten. But it's not impossible. Republicans are playing a dangerous game, and I think they have not learned the rules of all great generals: Never disrespect your adversary. Know him better than you know yourself. Republicans have not done this. They have little or no idea who our President really is.

Sunday, June 26, 2011

Why Have We Discarded Keynes?

I am not an economic historian and have not read the great economic theorists in the original. But after the September 2008 crisis hit, I found myself asking: Where were the economists? Why didn't they call it? Were they rewriting their theories? Any mea culpa's? Any apologies for leading the ship of state onto the rocks?

It is almost three years later. I have heard one apology, from Alan Greenspan, which was later softened or retracted. The Chicago School has not budged from its "efficient market", no such thing as an asset bubble approach. The Keynesians complain from the sidelines that no one understands that stimulus is good and necessary, when the consumer retrenches. The Republicans refused to join the majority on the Financial Crisis Inquiry Commission (which sited weak regulation, poor lending standards, perverse Wall Street incentives as principle causes of the crisis), and opted instead for blaming the entire mess on Fannie and Freddie, and their distortion of the housing market. In effect, in the Republican version, the GSEs' forced banks to reduce underwriting standards and make bad loans in order to increase minority home ownership. Neoclassicism reigns supreme: deficits are bad; government debt above certain levels will paralyze the country; government spending cannot create net new jobs; government borrowing will crowd out private borrowers, forcing interest rates up; and deadly inflation is just around the corner. But wasn't this the reigning economic ideology before the Crash? Why hasn't it been sent to the dustbin of history?

Didn't Herbert Hoover and his Treasury Secretary, Andrew Mellon, ascribe to this philosophy? Don't most people feel they got it wrong, and that only the Keynesian deficit spending of FDR pulled us out of the Depression? And wasn't it only the huge deficit spending of WWII that pulled us out of the Depression for good?

Why is neoclassicism still the "economic law of the land"?Why are the Keynesians, like Paul Krugman, having to play defense? Is Economics simply one of those soft sciences where you can make equally plausible cases for both sides of an argument? Or does ideology determine what we see out there in the world?

I am sad to say that ideology appears to trump. What we believe to be true is what we will always discover confirming evidence to support. Look at the climate debate. Over 98% of peer reviewed academic papers confirm that global warming is occurring and it has a human cause, at least in major part. Yet almost half the US population believes global warming is a hoax. How can this be? Look at evolution: the science has been set for over 100 years. Yet over 40% of the US believes the Genesis Creation Story is what actually happened.

Science has lost much of it's dominance and luster. Part of this started out as progress, as postmodernism (beginning in the late 1960s') showed us that even Science is speaking from an observational viewpoint, and that perspectives/context matter. But this new frame of "context aware" scientific inquiry has lead to "truth chaos", not more self-aware perspective-taking. We don't know what is true anymore, so there is no effective check to our belief systems moving in to resolve our uncertainties. This is a step backward, if we are not aware that is what we are doing. Eventually, this becomes a major move forward, as our leading edge of thinkers reaches integral awareness, where AND is the ruling word, where we let go of binary, choice-forcing ways of thinking, and we see the world as extraordinarily complex, rich, creative, and chaotic but that there are underlying principles and patterns that govern the "power and flow of things".

We can not predict when this awareness will begin to take firm hold. We are now in that confusing, in-between time when loud voices and firm convictions/faith rule the day, and "objective truth" seems illusory. But it will not always be this way. Martin Luther King said that "the arc of history is long, but it bends toward justice." I believe we can discern another and parallel arc of history that moves us from ideology to "truth-seeing and telling", where we distinguish our personal perspective, and know we are "researching the world" from this viewpoint, and with this "integral awareness" we can discern the pattern and flow of things, and this viewpoint will be broadly accepted.

For now, confusion reigns. The neoclassical, pre-Keynes, pre-New Deal viewpoint has emerged from the dustbin of history and reigns supreme - here in the US, in Cameron's Conservative UK, in Trichet's EU/ECB, in the IMF. Only in Asia (China, Japan especially) and the rapidly growing BRIC countries do we see happy and successful Keynesians presiding over economic policy. Will we, in the West, take a page from their books? Probably not, for we are developed; they are not; and what we are doing - austerity - is right for developed countries, and when they get to our level, they will follow us. When people say, "But I thought Japan was fully developed," the neoclassical Westerners, respond: "Japan is in the tank. Their growth is anemic. Debt/GDP just passed 200%. They will soon default. They need to be practicing austerity like we are."

To begin to penetrate the confusion, I will make a clarifying distinction: Neoclassical economics is clearly and powerfully associated with conservative politics. Conservatives are ascendant in the US, the UK, and the EU/ECB/IMF. The Prime Directive for conservatives is small/reduced government in the interest of free markets and individual freedom. GET THE GOVERNMENT OUT OF THE MIX. This has been the organizing principle, the rallying cry, the vital energy that organizes complex pieces and policies into coherent movement with visible direction. Tax policy comes out of this: reduce taxes, particularly on those most likely to invest and build the economy. Cut spending: what the government spends is not available to the private sector to spend, plus spending is what gives the government power to intervene in the economy, in our lives. Reorganize/cut entitlements: with people dependent on the government, the government will retain and increase it's power, and the people will become inefficient, and lose their entrepreneurial energy. Low taxes. Low spending. Small government.

If this is your passion, your economists too will support small government. They will argue that government spending will not work to boost employment and grow the economy; that high government debt levels will bankrupt the country; that deficits and debt will spur widespread, deadly inflation; that free markets work best and any government action interferes and potentially disables this efficient marketplace; that efficient markets always "clear", at the "right" price (no asset bubbles) and demand is always sufficient ( unemployment is not a labor demand problem, it is a supply of labor problem: interference in the market by government with labor regulations and workers choosing not to work; low GDP growth/recessions are caused by supply problems, where business, concerned about government interference and tax/regulatory uncertainty, withdraws production from the marketplace, causing economic growth to fall); and more generally, demand is never a problem in the economy - there will always be sufficient demand to absorb the supply offered (Say's Law), and where demand appears inadequate, government spending will simply cause the private sector to withhold an equivalent amount of spending (Ricardian Equivalence) due to a felt need to put away reserves to cover the taxes coming down the road to fund this new spending.

For the conservative, a complete package of supportive economic theory. The anti-inflation, hard money policies mostly originated with Milton Friedman, who appeared like a giant on the scene from the University of Chicago in the 1970s' with his Monetarist Policy that went a long way toward dethroning Keynes. The efficient market/never a demand problem/ supply side focus came from Friedman descendants at the University of Chicago, called the Chicago School, led by Eugene Fama and Robert Lucas.

Is the conservative package of economic ideas right, partly right or just plain wrong?

Mostly just plain wrong.

Friedman's Monetary Theory of Prices has elements of validity, especially, when the economy is operating at or near capacity and financial markets are heating up. Where he has been most wrong is precisely where he had the greatest impact: the idea that high government debt levels, deficit spending and increasing the money supply through debt issuance ("monetizing the debt") would cause serious inflation. Japan has run big deficits for most of the last 20 years with no inflation problems. On Friday, the US Treasury 10 year notes hit a 2011 low yield of about 2.93%, contrary to all predictions of what would happen when the Fed poured money into the economy in 2008/2009, providing liquidity for the financial system.

The Chicago School's efficient market hypothesis has been battered by the Crisis, but is tenaciously hanging on in conservative circles, because it suits the political agenda of bankers and Republicans. Similarly the "demand is never a problem" meme has been badly beaten, and should, in my opinion, be long gone, but it hangs on strongly in the political conversation, supporting the argument for attacking government deficit spending as unnecessary, inefficient and destructive. If demand will always be sufficient to clear the markets; if government spending/interference is always a problem; if deficits will always cause inflation - then Keynes is wrong and fiscal policy supported by the Democrats is poison for the economy. It is only a short step from here to attacking the debt ceiling increase and pushing for a balanced budget amendment.

So what should the President do? Obama, like most Democrats, is essentially Keynesian, at a time when neoclassicism is ascendant. Republicans and many Democrats are convinced we need austerity in order to move forward. Half the country accepts the "contractionary expansion" argument of the Republicans. The debt ceiling August 2 deadline is fast approaching. Critics on the Left argue the President must stop "leading from the rear." Republicans are saying the President must step out front and lay down the agenda he will support. Draw a line in the sand, Republicans say, so everyone knows where everyone stands. So what to do?

Recognizing that a Keynesian stimulus program is politically impossible right now, Obama's move, I believe, will be to minimize the damage to the economy from the budget cuts and hold out for essential fairness in sharing the coming sacrifice. Not a great Hope and Growth strategy, but appropriate to the context and the fierce conservative opposition. I think of the President as having to play the Russian General's game (Prince Kutuzov), retreating continuously before Napoleon's advance. Force the opposition to fully commit themselves. Let their positions become crystal clear. Then wait. At some point they will make a mistake and their own momentum will carry them into harm's way.

Obama has part way accomplished this, by not putting forward a "real budget", dilly-dallying in fact, until Rep. Ryan put his forward, and it quickly became Party orthodoxy, clarifying the Republican's real intentions for the first time since November 2008: Dismantle the large entitlement programs by turning them from defined benefit programs (as a Senior, my healthcare needs are met by Government program) to defined contribution programs (where the Government puts up a certain amount per year (over time, well below expected healthcare costs) and thus caps the Government's exposure). This alone might be a game changer: seniors and the white working/middle class will eventually rebel against a party that will take away its primary benefits, at the same time it supports added benefits for the wealthy in the form of tax cuts.

The debt ceiling is the next step. Obama would cut a deal with Republicans that would require significant budget cuts (including entitlements) if Republicans would put revenues on the table. Since it appears they won't, Obama must appear endlessly reasonable and always confident that good people can come together and find a fair solution. No lines in the sand, until it is absolutely necessary to do so. Some day, shortly before the end date of August 2, he should draw that line - announcing to the public that he will not agree to any arrangement that does not include revenue increases. Republicans are convinced the President will cave on the revenue question. When he does not, they will be very surprised. Then they will have a small amount of time to decide if they add some revenues in to make a deal, or if they follow the Tea Party off the economic cliff. My guess is that Wall Street Republicans, realizing default is imminent, will make Boehner relent. Result: No default. Major blow for Republicans, after endless statements of "no revenue increases" in the budget deal. Grover Norquist will be beside himself, etc. If this plays out, Republicans will be a long way toward disaster in November 2012, when Democrats can retake the House, and command a more growth oriented, Keynesian agenda.

If Obama blinks sooner, I think he will have a harder time being reelected.

If Republicans do not blink, and we go into default, and a true economic mess ensues, suspect initially it will be a "pox on both your houses", but that effective management of the economy after the second crisis, could put Obama, and Keynes, back on top.

In any case, we will probably not have a single, shared economic perspective any time soon. It is in the interest of Republicans to be anti-Keynesians, and they will continue to follow that path. Keynes will most likely only be reinstated if Obama and Democrats have a decisive win in November 2012.

So what should the President do? Obama, like most Democrats, is essentially Keynesian, at a time when neoclassicism is ascendant. Republicans and many Democrats are convinced we need austerity in order to move forward. Half the country accepts the "contractionary expansion" argument of the Republicans. The debt ceiling August 2 deadline is fast approaching. Critics on the Left argue the President must stop "leading from the rear." Republicans are saying the President must step out front and lay down the agenda he will support. Draw a line in the sand, Republicans say, so everyone knows where everyone stands. So what to do?

Recognizing that a Keynesian stimulus program is politically impossible right now, Obama's move, I believe, will be to minimize the damage to the economy from the budget cuts and hold out for essential fairness in sharing the coming sacrifice. Not a great Hope and Growth strategy, but appropriate to the context and the fierce conservative opposition. I think of the President as having to play the Russian General's game (Prince Kutuzov), retreating continuously before Napoleon's advance. Force the opposition to fully commit themselves. Let their positions become crystal clear. Then wait. At some point they will make a mistake and their own momentum will carry them into harm's way.

Obama has part way accomplished this, by not putting forward a "real budget", dilly-dallying in fact, until Rep. Ryan put his forward, and it quickly became Party orthodoxy, clarifying the Republican's real intentions for the first time since November 2008: Dismantle the large entitlement programs by turning them from defined benefit programs (as a Senior, my healthcare needs are met by Government program) to defined contribution programs (where the Government puts up a certain amount per year (over time, well below expected healthcare costs) and thus caps the Government's exposure). This alone might be a game changer: seniors and the white working/middle class will eventually rebel against a party that will take away its primary benefits, at the same time it supports added benefits for the wealthy in the form of tax cuts.

The debt ceiling is the next step. Obama would cut a deal with Republicans that would require significant budget cuts (including entitlements) if Republicans would put revenues on the table. Since it appears they won't, Obama must appear endlessly reasonable and always confident that good people can come together and find a fair solution. No lines in the sand, until it is absolutely necessary to do so. Some day, shortly before the end date of August 2, he should draw that line - announcing to the public that he will not agree to any arrangement that does not include revenue increases. Republicans are convinced the President will cave on the revenue question. When he does not, they will be very surprised. Then they will have a small amount of time to decide if they add some revenues in to make a deal, or if they follow the Tea Party off the economic cliff. My guess is that Wall Street Republicans, realizing default is imminent, will make Boehner relent. Result: No default. Major blow for Republicans, after endless statements of "no revenue increases" in the budget deal. Grover Norquist will be beside himself, etc. If this plays out, Republicans will be a long way toward disaster in November 2012, when Democrats can retake the House, and command a more growth oriented, Keynesian agenda.

If Obama blinks sooner, I think he will have a harder time being reelected.

If Republicans do not blink, and we go into default, and a true economic mess ensues, suspect initially it will be a "pox on both your houses", but that effective management of the economy after the second crisis, could put Obama, and Keynes, back on top.

In any case, we will probably not have a single, shared economic perspective any time soon. It is in the interest of Republicans to be anti-Keynesians, and they will continue to follow that path. Keynes will most likely only be reinstated if Obama and Democrats have a decisive win in November 2012.

Thursday, June 23, 2011

Why We Need Deficits (Part III)

Here is a terrific chart showing the Sectoral Balances since 1952:

This is worth some study. If you want to see the detailed numbers behind this chart,

here is the link: Sectoral Balances . Some observations:

1. Blue, which is Net Private, ran positive continuously until 1997. From there until 2nd Qtr, 2008, it ran negative, with a slight positive balance through 2003. What happened in 1997 is that the consumer began a serious borrowing binge, which ended abruptly in 2008, when housing prices collapsed. By early 2009, the consumer was deleveraging, i.e., saving, at an historically high rate, and although the External Sector Balance improved, the slack was necessarily taken up by an offsetting increase in the Government Deficit.

2. The Clinton surplus was supported by an historic run-up in private borrowing. The Bush economy was similarly financed. Had the credit bubble not been building during the Bush years, and if consumers had been saving at historical rates, the Bush deficits would have matched current levels. Specifically, if the 2006 Private Sector Balance had been 3.8% positive, instead of 3.8% negative, the deficit would have been 10%, not 2.2%, exactly our current level.

3. It's impossible to look at this chart and not see that a healthy US economy has a Government Sector Deficit that supports a Foreign Trade Deficit (hopefully more in line with current levels (2.5% - 3.5%) than the 5% - 6% range under Bush) and Net Private Savings. For example, a 3% negative trade balance and a 4% private savings rate would require a 7% deficit.

A balanced budget amendment in this context is ridiculous. Austerity budget cuts make no sense. Why do none of our leaders understand this? Why have many, if not most, mainline economists supported the austerity position? We will look into the changing perspectives of our leading economists over the last forty years in my next blog.

This is worth some study. If you want to see the detailed numbers behind this chart,

here is the link: Sectoral Balances . Some observations:

1. Blue, which is Net Private, ran positive continuously until 1997. From there until 2nd Qtr, 2008, it ran negative, with a slight positive balance through 2003. What happened in 1997 is that the consumer began a serious borrowing binge, which ended abruptly in 2008, when housing prices collapsed. By early 2009, the consumer was deleveraging, i.e., saving, at an historically high rate, and although the External Sector Balance improved, the slack was necessarily taken up by an offsetting increase in the Government Deficit.

2. The Clinton surplus was supported by an historic run-up in private borrowing. The Bush economy was similarly financed. Had the credit bubble not been building during the Bush years, and if consumers had been saving at historical rates, the Bush deficits would have matched current levels. Specifically, if the 2006 Private Sector Balance had been 3.8% positive, instead of 3.8% negative, the deficit would have been 10%, not 2.2%, exactly our current level.

3. It's impossible to look at this chart and not see that a healthy US economy has a Government Sector Deficit that supports a Foreign Trade Deficit (hopefully more in line with current levels (2.5% - 3.5%) than the 5% - 6% range under Bush) and Net Private Savings. For example, a 3% negative trade balance and a 4% private savings rate would require a 7% deficit.

A balanced budget amendment in this context is ridiculous. Austerity budget cuts make no sense. Why do none of our leaders understand this? Why have many, if not most, mainline economists supported the austerity position? We will look into the changing perspectives of our leading economists over the last forty years in my next blog.

Why We Need Deficits (Part II)

Here is an excellent analysis of the Sectoral Analysis approach to macroeconomics from The Pragmatic Capitalist . Remember that the sector balances must net to zero. Funds flows in the Private Sector, the Government Sector and the External Sector must offset and net to zero. Usually, these are expressed as a percent of GDP.

First, as promised, will show the very simple but not arguable math on which this is based.

We learn in Econ 101 (51 years ago for me!), we learn that:

GDP = C + G + I + (X - M), or

GDP = Consumption + Government + Private Investment + (Exports - Imports)

This is the Sources side. There is an equivalent Uses side:

GDP = C + S + T, or

GDP = Consumption + Savings + Taxes, so:

C + G + I + (X - M) = C + S + T

Strike out the Cs', transpose, and you have:

(G-T) + (X - M) = (S - I)

The left side is the Sources - Deficit plus Current Account Surplus

The right side is Uses - Net Private Savings

Sources must equal Uses, or Sources and Uses must net to zero.

And here is this described in some detail by the Pragmatic Capitalist :

First, as promised, will show the very simple but not arguable math on which this is based.

We learn in Econ 101 (51 years ago for me!), we learn that:

GDP = C + G + I + (X - M), or

GDP = Consumption + Government + Private Investment + (Exports - Imports)

This is the Sources side. There is an equivalent Uses side:

GDP = C + S + T, or

GDP = Consumption + Savings + Taxes, so:

C + G + I + (X - M) = C + S + T

Strike out the Cs', transpose, and you have:

(G-T) + (X - M) = (S - I)

The left side is the Sources - Deficit plus Current Account Surplus

The right side is Uses - Net Private Savings

Sources must equal Uses, or Sources and Uses must net to zero.

And here is this described in some detail by the Pragmatic Capitalist :

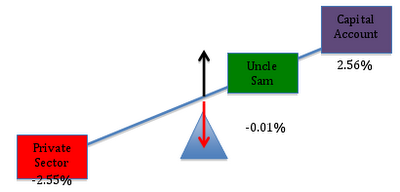

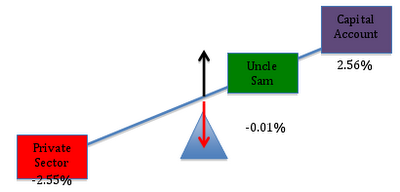

To see this in the context of the teeter-totter model, let’s initially hold the public sector’s balance constant at zero (i.e. let’s assume the government is balancing its budget so that G = T). With the government budget in balance, Uncle Sam is a “weightless” entity on the teeter-totter, so that the private sector’s financial position will simply reflect the “weight” of the capital account. Suppose, first, that the current account is in surplus (i.e. the capital account shows an equivalent deficit):

The image above depicts the benefit (to the private sector) of a current account surplus (a.k.a a capital account deficit), and it is the outcome that many of you accused me of sidestepping in my previous post. Of course, the U.S. does not have a current account surplus, so let’s address that point before moving on. (And lest anyone begin to hyperventilate, I’ll also address the fact that G ≠ T). First, the current account.

Sticking with (G = T) for the moment, we can show how a current account deficit impacts the private sector’s financial position. As the capital account moves from deficit (diagram above) into surplus (diagram below), we see that the private sector’s financial position moves from surplus into deficit.

But does this all of this hold true in the real world, or is it some kind of economic chicanery? Let’s check the facts.

Equations [2] and [3] above are not based on economic theory. They are accounting identities that always “add up” in the real world. So let’s firm up the discussion about the implications of government “belt tightening” by running through some examples using the real world data found in the table below (Hat tip to Scott Fullwilir for sharing the file. All of the data comes from the National Income and Product Accounts (NIPA) and the Flow of Funds.)

Let’s begin with the data from 1998 (Q3), when the public sector deficit was just 0.01% of GDP and the current account deficit was 2.56% of GDP. Plugging these numbers into equation [2] above, the identity tells us (and the data in the table confirm) that the private sector’s balance must have been:

[2] Domestic Private Sector’s Balance = 0.01% + (-2.56% )= -2.55%

Here, we can see that the private sector’s financial position was deteriorating because it was making large (net) payments to foreigners. Because this loss of financial resources was not offset by the public sector, the private sector’s financial position deteriorated.

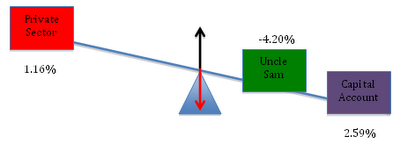

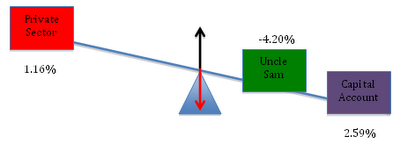

To see how a bigger government deficit would have improved the private sector’s financial position, let’s look at the data from 1988 (Q1). As a percent of GDP, the current account balance was 2.59%, nearly the same as before, while the government’s deficit came in at a much higher 4.2% of GDP. We can use Equation [2] to see effect of the larger budget deficit:

[2] Domestic Private Sector’s Balance = 4.2% + (-2.59%) = 1.61%

In this period, the private sector ends up with a surplus because the government’s deficit was large enough to more than offset the negative effect of the current account deficit.

Again, this is simply a property of the sectoral balance sheet identities. Whenever the government’s deficit is too small to offset a deficit in the current account, the private sector will experience a net loss. The result my ruffle your feathers, but it is an unimpeachable fact.

Wednesday, June 22, 2011

Why We Need Deficits

For the past two weeks, have been studying MMT or Modern Monetary theory. New Economic Perspectives and Billy Blog are good places to go to get both flavor and details of MMT. If these folks are right, and they make mighty persuasive arguments, we don't have a deficit problem. What's more, the idea that we have a looming sovereign debt level crisis, that our public debt to GDP is moving into an unsustainable range, is just plain wrong. I will be returning to this a lot in the future, since it turns the current political conversation on it's head. But let me start out with just a few headlines:

1. The US, and other sovereign countries with their own currencies, cannot go broke. The comparison with an individual household that can go broke is simply wrong. Any sovereign country, with a "fiat currency", can simply issue new currency or debt to pay outstanding obligations.

2. We hear talk of sovereign debt default. Turns out no sovereign nation with their own currency not pegged to a fixed rate or a currency board has ever defaulted. Russia, Argentina, et al. were pegged to rates when they defaulted.

3. We are told with absolute certainty that serious inflation is just around the corner, that the budget deficits and the increasing debt levels will without any question lead to out of control inflation. This is the famous bond vigilante conversation: people/institutions/markets will lose confidence in US economic policy, will massively sell Treasuries, prices of the bonds will tank, interest rates will spike, and inflation will take off. It simply has not happened. Ten year Treasuries remain near 3%, almost historical lows.

4. We are told that formal economic studies show conclusively that public debt to GDP levels cannot go above 60% or major inflation and economic breakdown will occur. Meanwhile, Japan's debt level just passed 200%, while interest rates remain near zero with little inflation in sight. The economy has struggled along with low growth for 20 years, because zombie banks and businesses have been nursed along instead of shut down or restructured. But no inflation. No default. No problem raising funds in the bond markets, even though Japan was downgraded by Standard & Poor.

Where does this anti-deficit, inflation fearing, debt/insolvency concern come from? Republicans have held these views for a long time, perhaps forever, but certainly from before the New Deal. But through the New Deal and through the Johnson years and Medicare/Medicaid of the 60s', Democrats have been strong supporters of fiscal policy and deficits to support public policy. Now most join Republicans in their anti-stimulus, ant-deficit, budget-cutting policy proposals. Why? I am honestly not sure, but austerity mania is clearly a trans-Atlantic phenomenon, dominating Britain and the troubled peripheral countries of Europe and the ECB. Almost everyone seems to buy into the idea that the way to grow is to cut spending, shrink the deficit, balance the budget, reduce debt. Contractionary expansion. And MMT says this is just plain wrong.

MMT tells us that government sector budget deficits are necessary to support private sector savings and external sector trade imbalance. This is not opinion. This is accounting identity. In my next blog, I will show the quite simple math, but for now, the conclusion: Fund flows in the three sectors must net to zero.

So, Government ( G-T, Spending less Taxes), Private (S-I, Private Savings less Private Investment), External (X-M, Exports less Imports) - the net of these three sector balances must equal zero. So Government Deficits must be present if the External Balance is negative and the Private sector is net saving. Said differently, the Sources and Uses of funds in the three sectors must net to zero. Deficits are a Source. Net Private Saving and a negative Trade Balance are both Uses. So if there is Private Saving and a negative Trade Balance, there will be Government Deficits. This is not opinion. This is simple math.

So how did Clinton achieve a budget surplus and good GDP growth? Private credit expansion. How have we had such generally positive economic growth in the last thirty years not running up large deficits until the end of the period? To a very large extent, private credit expansion. Looking at the Private Debt accumulation in the last thirty years is a sobering experience. Until very recently, we have not needed the Government to fund Private Saving and our Trade Imbalance. The consumer and private business have been doing it through private credit expansion, i.e., dis-saving.

Starting in 2007, and surging ahead with the September, 2008 crisis, both the consumer and business are deleveraging, paying off debts, repairing the balance sheet. That is the main reason for the deficits. And that is why we can call this the Balance Sheet Recession.

We need deficits, or else we will starve our economy. Austerity is exactly the wrong way to go. How long this recession lasts will depend on how long it takes the private consumer and business to repair their balance sheets. And unless we want to follow the Japanese, we should not continue to support our zombie banks. And if they can be put through resolution, we can address the underwater mortgage disaster through serious mortgage modifications, and help significantly to clean up private balance sheets.

In my next post, will look for some charts to demonstrate the above.

1. The US, and other sovereign countries with their own currencies, cannot go broke. The comparison with an individual household that can go broke is simply wrong. Any sovereign country, with a "fiat currency", can simply issue new currency or debt to pay outstanding obligations.

2. We hear talk of sovereign debt default. Turns out no sovereign nation with their own currency not pegged to a fixed rate or a currency board has ever defaulted. Russia, Argentina, et al. were pegged to rates when they defaulted.

3. We are told with absolute certainty that serious inflation is just around the corner, that the budget deficits and the increasing debt levels will without any question lead to out of control inflation. This is the famous bond vigilante conversation: people/institutions/markets will lose confidence in US economic policy, will massively sell Treasuries, prices of the bonds will tank, interest rates will spike, and inflation will take off. It simply has not happened. Ten year Treasuries remain near 3%, almost historical lows.

4. We are told that formal economic studies show conclusively that public debt to GDP levels cannot go above 60% or major inflation and economic breakdown will occur. Meanwhile, Japan's debt level just passed 200%, while interest rates remain near zero with little inflation in sight. The economy has struggled along with low growth for 20 years, because zombie banks and businesses have been nursed along instead of shut down or restructured. But no inflation. No default. No problem raising funds in the bond markets, even though Japan was downgraded by Standard & Poor.

Where does this anti-deficit, inflation fearing, debt/insolvency concern come from? Republicans have held these views for a long time, perhaps forever, but certainly from before the New Deal. But through the New Deal and through the Johnson years and Medicare/Medicaid of the 60s', Democrats have been strong supporters of fiscal policy and deficits to support public policy. Now most join Republicans in their anti-stimulus, ant-deficit, budget-cutting policy proposals. Why? I am honestly not sure, but austerity mania is clearly a trans-Atlantic phenomenon, dominating Britain and the troubled peripheral countries of Europe and the ECB. Almost everyone seems to buy into the idea that the way to grow is to cut spending, shrink the deficit, balance the budget, reduce debt. Contractionary expansion. And MMT says this is just plain wrong.

MMT tells us that government sector budget deficits are necessary to support private sector savings and external sector trade imbalance. This is not opinion. This is accounting identity. In my next blog, I will show the quite simple math, but for now, the conclusion: Fund flows in the three sectors must net to zero.

So, Government ( G-T, Spending less Taxes), Private (S-I, Private Savings less Private Investment), External (X-M, Exports less Imports) - the net of these three sector balances must equal zero. So Government Deficits must be present if the External Balance is negative and the Private sector is net saving. Said differently, the Sources and Uses of funds in the three sectors must net to zero. Deficits are a Source. Net Private Saving and a negative Trade Balance are both Uses. So if there is Private Saving and a negative Trade Balance, there will be Government Deficits. This is not opinion. This is simple math.

So how did Clinton achieve a budget surplus and good GDP growth? Private credit expansion. How have we had such generally positive economic growth in the last thirty years not running up large deficits until the end of the period? To a very large extent, private credit expansion. Looking at the Private Debt accumulation in the last thirty years is a sobering experience. Until very recently, we have not needed the Government to fund Private Saving and our Trade Imbalance. The consumer and private business have been doing it through private credit expansion, i.e., dis-saving.

Starting in 2007, and surging ahead with the September, 2008 crisis, both the consumer and business are deleveraging, paying off debts, repairing the balance sheet. That is the main reason for the deficits. And that is why we can call this the Balance Sheet Recession.

We need deficits, or else we will starve our economy. Austerity is exactly the wrong way to go. How long this recession lasts will depend on how long it takes the private consumer and business to repair their balance sheets. And unless we want to follow the Japanese, we should not continue to support our zombie banks. And if they can be put through resolution, we can address the underwater mortgage disaster through serious mortgage modifications, and help significantly to clean up private balance sheets.

In my next post, will look for some charts to demonstrate the above.

Tuesday, June 14, 2011

The Republican Debate - Tuesday, June 14

I watched the debate last night, not so much to pick winners and losers, but to try and get a feel for how Republicans view where we are and what's coming. I'm not talking about specific issues: budget cuts, Medicare, raising the debt ceiling. I'm interested in determining if there is some vision of the future held individually, or collectively. If Republicans had a magic wand, and were able to put their policies and programs into effect, what would it look like?

Here's what I come up with: Taxes on business and individuals would be very significantly reduced. The Healthcare Bill (ACA) would be repealed. Medicaid and Medicare would be changed from a defined benefit to a defined contribution program, with its benefit inflator set at the rate of overall inflation, well below the medical cost inflation rate. Social Security would be trimmed back, most likely raising the retirement age and means testing benefits. Discretionary government spending (Education, Energy, Transportation, Agriculture, etc) would be significantly reduced. Government's regulatory functions would be scaled way back - most of Dodd-Frank would be repealed. Defense funding, on the other hand, would remain strong. Unions, particularly public sector unions, would lose most of their power. Many functions of the government would be moved down to the state level, if they weren't eliminated.

I am convinced Republicans believe that if this program were put into effect, the economy would grow at unprecedented rates (Tim Pawlenty says 5% growth per year for 10 years). Regulatory, tax, deficit and entitlement affordability uncertainties would be eliminated in one fell swoop. It is these uncertainties that have, Republicans believe, stymied our present recovery. Once removed, the economy will explode.

I believe every Republican on the stage last night believes this. I don't. Leaving questions of morality or compassion out of the discussion for the moment, I think it is bad economics. It may also be bad politics, and if the Democrats frame the conversation well, we will find out next November. But I am not talking about politics right now; I'm talking economics and a small bit of history.

After the Big Crash in 1929, Herbert Hoover, supported by his Treasury Secretary, Andrew Mellon, called for significant government spending cuts, tight monetary policy, deregulation and privatization, exactly what Republicans want now. Why would it work now, when it didn't work then?

Tax rates and business confidence are not the problems. It's demand. Economics 101, which I took 51 years ago, gave me this formula, which still applies today:

GDP = C + G + I +(X-M)

GDP = Consumption plus Government Spending plus Business/Private Investment plus Net Exports.

70% of this is C, or consumption. In other words demand. Consumers are buried under a mountain of debt; they are reducing this debt and deleveraging, which pulls money out of the economy. Businesses are not investing, not because they do not have the necessary confidence, but because they don't have the necessary orders. GDP is in the tank because there is so little demand.

Do we think the personal income or business tax cuts will significantly increase Consumption, which business needs to see before they increase Investment? Republicans do. I don't. The evidence from the Bush tax cuts, put in after a much shallower recession, would say the Republicans are wrong. Income tax cuts, particularly investment income tax cuts, simply do not reach 60% , even up to 80% of the US population. So how can the economy explode? If C is stagnant, and G is cut way back, and I won't move far without some energy from C, are we going to pin our hopes on an export boom? Suspect we'll make progress, but a boom sufficient to take us to 5% GDP growth? Don't think so.

The most likely picture for me is a second 10 year run for Wall Street: If we take the regulators off their backs, "clarify" the long term entitlement contingency (capping benefits), and give the investor class a lot more money, the action will be, once again, on the Street: new, complex financial products sold around the world at phenomenal margins, with towers of leverage, and huge profits for investors, but little impact on the real economy.

And if broad-based growth doesn't happen, and we get, instead the anemic growth rates of the Bush years, with huge run ups in asset values, giant profits for Wall Street, and who knows what at the end - what do you think will happen to deficits? Take Pawlenty's tax plan and cut growth rates to what we saw between 2001 and 2007, and you have an amazing mess on your hands.

The Republican vision simply won't work. We need demand through the entire economy, not large tax reductions flowing to a very small percentage of the population. We need strong regulation of Wall Street or we'll be right back to the Fall of 2008. We need broad-based growth in the real economy, and for that to happen, government will need to play a major role.

Here's what I come up with: Taxes on business and individuals would be very significantly reduced. The Healthcare Bill (ACA) would be repealed. Medicaid and Medicare would be changed from a defined benefit to a defined contribution program, with its benefit inflator set at the rate of overall inflation, well below the medical cost inflation rate. Social Security would be trimmed back, most likely raising the retirement age and means testing benefits. Discretionary government spending (Education, Energy, Transportation, Agriculture, etc) would be significantly reduced. Government's regulatory functions would be scaled way back - most of Dodd-Frank would be repealed. Defense funding, on the other hand, would remain strong. Unions, particularly public sector unions, would lose most of their power. Many functions of the government would be moved down to the state level, if they weren't eliminated.

I am convinced Republicans believe that if this program were put into effect, the economy would grow at unprecedented rates (Tim Pawlenty says 5% growth per year for 10 years). Regulatory, tax, deficit and entitlement affordability uncertainties would be eliminated in one fell swoop. It is these uncertainties that have, Republicans believe, stymied our present recovery. Once removed, the economy will explode.

I believe every Republican on the stage last night believes this. I don't. Leaving questions of morality or compassion out of the discussion for the moment, I think it is bad economics. It may also be bad politics, and if the Democrats frame the conversation well, we will find out next November. But I am not talking about politics right now; I'm talking economics and a small bit of history.

After the Big Crash in 1929, Herbert Hoover, supported by his Treasury Secretary, Andrew Mellon, called for significant government spending cuts, tight monetary policy, deregulation and privatization, exactly what Republicans want now. Why would it work now, when it didn't work then?

Tax rates and business confidence are not the problems. It's demand. Economics 101, which I took 51 years ago, gave me this formula, which still applies today:

GDP = C + G + I +(X-M)

GDP = Consumption plus Government Spending plus Business/Private Investment plus Net Exports.

70% of this is C, or consumption. In other words demand. Consumers are buried under a mountain of debt; they are reducing this debt and deleveraging, which pulls money out of the economy. Businesses are not investing, not because they do not have the necessary confidence, but because they don't have the necessary orders. GDP is in the tank because there is so little demand.

Do we think the personal income or business tax cuts will significantly increase Consumption, which business needs to see before they increase Investment? Republicans do. I don't. The evidence from the Bush tax cuts, put in after a much shallower recession, would say the Republicans are wrong. Income tax cuts, particularly investment income tax cuts, simply do not reach 60% , even up to 80% of the US population. So how can the economy explode? If C is stagnant, and G is cut way back, and I won't move far without some energy from C, are we going to pin our hopes on an export boom? Suspect we'll make progress, but a boom sufficient to take us to 5% GDP growth? Don't think so.

The most likely picture for me is a second 10 year run for Wall Street: If we take the regulators off their backs, "clarify" the long term entitlement contingency (capping benefits), and give the investor class a lot more money, the action will be, once again, on the Street: new, complex financial products sold around the world at phenomenal margins, with towers of leverage, and huge profits for investors, but little impact on the real economy.

And if broad-based growth doesn't happen, and we get, instead the anemic growth rates of the Bush years, with huge run ups in asset values, giant profits for Wall Street, and who knows what at the end - what do you think will happen to deficits? Take Pawlenty's tax plan and cut growth rates to what we saw between 2001 and 2007, and you have an amazing mess on your hands.

The Republican vision simply won't work. We need demand through the entire economy, not large tax reductions flowing to a very small percentage of the population. We need strong regulation of Wall Street or we'll be right back to the Fall of 2008. We need broad-based growth in the real economy, and for that to happen, government will need to play a major role.

Monday, June 13, 2011

The Foreclosure Mess - Monday, June 13, 2011

I have an old-fashioned viewpoint: when you do something wrong, you own up. You take responsibility for your actions. If appropriate, you apologize and make redress.

One of the things that has amazed me, and then has made me angry, is that almost no one has stood up and taken their share of the blame for the financial crisis. Surprisingly, Greenspan, the Maestro, did, for one brief moment, acknowledge error. His assumption that markets would self police and manage their own risk proved wrong, and he, at least briefly, admitted it. Not many others have done so.

As I began to study the crisis to try and figure out what happened (I began "reading around" shortly after the crisis hit in the Fall of 2008), it was clear that the investment banks and the big four mortgage servicer banks (Bank of America, JPMorgan Chase, Citibank, and Wells Fargo) had played very bad games, and they were neither taking responsibility for it, nor were they being held to account.

I can (sort of) forgive Paulson and Geithner for negotiating bad deals with the banks - deals that gave the banks just what they needed but exacted no "pound of flesh" or tough give-backs as part of the deal. The sky was falling. The markets were in collapse. They had to get credit flowing again. But why were the bank stress tests so forgiving? Why have there been almost no fraud or criminal investigations at the federal level? Why has there been no serious relief for homeowners? Why has Treasury not pursued the banks for their multiple paperwork disasters in properly conveying notes and mortgages into the securitization trusts?

As an Obama supporter, this continues to baffle me. Do the banks control the Democrats as well as the Republicans? Is Geithner just too close to the banks? Is he worried that the banks are too fragile and pushing them hard might topple them and hurt the economy? Is this part of Obama's often-used strategy of simply waiting and letting the problem come to him, so he is not seen as starting the fight? I just do not know. Neither the President nor Geithner are stupid. They must know there are big paperwork problems with proving up the perfected security interests for the notes and mortgages in the trusts? Can't they see that the rate of new and completed foreclosures has fallen off big time in the last few months, and that the very high probability reason is that the banks don't have the papers in order to be able to foreclose, and now that the defense bar is wide awake and armed with great strategies, the banks are being picked off in court right and left? Do they really think this problem is going away? Or did they not want to be the ones to pick the fight, hoping or knowing that some aggressive state attorney general would take up the fight, and the feds/the Democrats/Obama would not have to be the ones to pick the fight.

I am truly not sure of the answer. But if the President and Secretary Geithner were praying for an aggressive state AG to take on the banks, their prayers have been answered. Attorneys General Schneiderman (New York) and Biden (Delaware) have answered the call, and are taking on the banks on this very issue of proper conveyance of notes and mortgages into the trusts. Yves Smith at naked capitalism.com put up the story this morning. Here's the link here. She (Yves Smith) is an extremely smart and articulate blogger, formerly worked at Goldman Sachs, has written a powerful book Econned, which I highly recommend, knows the ins and outs of the Street, and has been all over this story since the crisis and before. If this topic interests you, look back through her archives, do some searches. She puts together better investment/mortgage securitization material than I ever saw at Harvard Business School.

This could be a very big deal. Yves' research shows that at some point around 2002, the securitization industry stopped following the note and mortgage conveyance rules they had set up in their standard PSA (Pooling and Servicing Agreement, the central agreement in all the private securitizations conveying the many notes and mortgages into the trust, setting up the servicing agreement with the banks servicer, and thereby laying down conditions for foreclosure, if necessary.) She doesn't know why they did this, and bank representatives furiously dispute the truth of her claims. But I'm convinced she is right. A VP at a major servicer confirmed to me that they the bank HQ held on to the original notes, instead of sending them to the trust, as required by the PSA.

Although case law is just being formed on some of these questions, recent decisions look like they will confirm the argument Yves presents that New York trust law will govern, and that the specific terms of the PSA must be honored. The industry organization, the ASF (American Securitization Forum) has argued that despite the PSA provisions, the original note need not be present,and that the individual mortgage note does not need to have every intervening assignment visible, and can, in fact, be endorsed in blank. It simply does not look like this argument will prevail, and now that two AGs are calling for the original documents from the trusts, it is possible, not certain, that the truth will come to light, and the banks will finally be held accountable.

If the papers are not there, or are seriously deficient, what does this mean? It means that the RMBS market (Residential Mortgage-Backed Securities market) might have to be renamed the RNMBS market (Residential Non-Mortgage-Backed Securities market). Six years worth of mortgage securitizations could unravel, which would literally break the banks and throw millions of titles into dispute. Do I think this will happen? Probably not. But it might. And I think there is a better than even chance that one bank will go down, and that will probably be Bank of America.

The arrogance of the banks has been just stunning. Stopping foreclosures for a time, when the robosigning scandal hit, then starting them back up a short time later, saying, in every case, that thorough investigations revealed no problems. But why would the servicers need to robosign, if the papers were there? And remember: Trustee banks sign a sworn affidavit every year, affirming that all the notes and mortgages, in the proper form required by the PSA, are present in the Trust files. The Statute of Limitations has mostly run out on fraud charges, but not for contract formation failure, and not for the trustee banks with their annual affirmations.

I believe we must go through this, in whatever painful form it will take. Perhaps the auto-bailout/packaged bankruptcy is a good model. Restructure. Clean up. Clear the market. Move forward.

And finally, the banks will be held to account. Not for the frightful risks they took with other people's money. Not for screwing their own customers consistently by trading against them in the same securities they were touting and selling. Not for creating financial instruments that took crap mortgages (which they knew were crap) and magically turned this into AAA paper, They will be caught on the low-status back room stuff - the paperwork processing and conveyance of notes and mortgages to the trusts. But I now believe they will be held to account.

And remember: Al Capone was taken down for tax evasion!

Remember: they got Al Capone on tax evasion.

One of the things that has amazed me, and then has made me angry, is that almost no one has stood up and taken their share of the blame for the financial crisis. Surprisingly, Greenspan, the Maestro, did, for one brief moment, acknowledge error. His assumption that markets would self police and manage their own risk proved wrong, and he, at least briefly, admitted it. Not many others have done so.

As I began to study the crisis to try and figure out what happened (I began "reading around" shortly after the crisis hit in the Fall of 2008), it was clear that the investment banks and the big four mortgage servicer banks (Bank of America, JPMorgan Chase, Citibank, and Wells Fargo) had played very bad games, and they were neither taking responsibility for it, nor were they being held to account.

I can (sort of) forgive Paulson and Geithner for negotiating bad deals with the banks - deals that gave the banks just what they needed but exacted no "pound of flesh" or tough give-backs as part of the deal. The sky was falling. The markets were in collapse. They had to get credit flowing again. But why were the bank stress tests so forgiving? Why have there been almost no fraud or criminal investigations at the federal level? Why has there been no serious relief for homeowners? Why has Treasury not pursued the banks for their multiple paperwork disasters in properly conveying notes and mortgages into the securitization trusts?

As an Obama supporter, this continues to baffle me. Do the banks control the Democrats as well as the Republicans? Is Geithner just too close to the banks? Is he worried that the banks are too fragile and pushing them hard might topple them and hurt the economy? Is this part of Obama's often-used strategy of simply waiting and letting the problem come to him, so he is not seen as starting the fight? I just do not know. Neither the President nor Geithner are stupid. They must know there are big paperwork problems with proving up the perfected security interests for the notes and mortgages in the trusts? Can't they see that the rate of new and completed foreclosures has fallen off big time in the last few months, and that the very high probability reason is that the banks don't have the papers in order to be able to foreclose, and now that the defense bar is wide awake and armed with great strategies, the banks are being picked off in court right and left? Do they really think this problem is going away? Or did they not want to be the ones to pick the fight, hoping or knowing that some aggressive state attorney general would take up the fight, and the feds/the Democrats/Obama would not have to be the ones to pick the fight.

I am truly not sure of the answer. But if the President and Secretary Geithner were praying for an aggressive state AG to take on the banks, their prayers have been answered. Attorneys General Schneiderman (New York) and Biden (Delaware) have answered the call, and are taking on the banks on this very issue of proper conveyance of notes and mortgages into the trusts. Yves Smith at naked capitalism.com put up the story this morning. Here's the link here. She (Yves Smith) is an extremely smart and articulate blogger, formerly worked at Goldman Sachs, has written a powerful book Econned, which I highly recommend, knows the ins and outs of the Street, and has been all over this story since the crisis and before. If this topic interests you, look back through her archives, do some searches. She puts together better investment/mortgage securitization material than I ever saw at Harvard Business School.

This could be a very big deal. Yves' research shows that at some point around 2002, the securitization industry stopped following the note and mortgage conveyance rules they had set up in their standard PSA (Pooling and Servicing Agreement, the central agreement in all the private securitizations conveying the many notes and mortgages into the trust, setting up the servicing agreement with the banks servicer, and thereby laying down conditions for foreclosure, if necessary.) She doesn't know why they did this, and bank representatives furiously dispute the truth of her claims. But I'm convinced she is right. A VP at a major servicer confirmed to me that they the bank HQ held on to the original notes, instead of sending them to the trust, as required by the PSA.

Although case law is just being formed on some of these questions, recent decisions look like they will confirm the argument Yves presents that New York trust law will govern, and that the specific terms of the PSA must be honored. The industry organization, the ASF (American Securitization Forum) has argued that despite the PSA provisions, the original note need not be present,and that the individual mortgage note does not need to have every intervening assignment visible, and can, in fact, be endorsed in blank. It simply does not look like this argument will prevail, and now that two AGs are calling for the original documents from the trusts, it is possible, not certain, that the truth will come to light, and the banks will finally be held accountable.

If the papers are not there, or are seriously deficient, what does this mean? It means that the RMBS market (Residential Mortgage-Backed Securities market) might have to be renamed the RNMBS market (Residential Non-Mortgage-Backed Securities market). Six years worth of mortgage securitizations could unravel, which would literally break the banks and throw millions of titles into dispute. Do I think this will happen? Probably not. But it might. And I think there is a better than even chance that one bank will go down, and that will probably be Bank of America.

The arrogance of the banks has been just stunning. Stopping foreclosures for a time, when the robosigning scandal hit, then starting them back up a short time later, saying, in every case, that thorough investigations revealed no problems. But why would the servicers need to robosign, if the papers were there? And remember: Trustee banks sign a sworn affidavit every year, affirming that all the notes and mortgages, in the proper form required by the PSA, are present in the Trust files. The Statute of Limitations has mostly run out on fraud charges, but not for contract formation failure, and not for the trustee banks with their annual affirmations.

I believe we must go through this, in whatever painful form it will take. Perhaps the auto-bailout/packaged bankruptcy is a good model. Restructure. Clean up. Clear the market. Move forward.

And finally, the banks will be held to account. Not for the frightful risks they took with other people's money. Not for screwing their own customers consistently by trading against them in the same securities they were touting and selling. Not for creating financial instruments that took crap mortgages (which they knew were crap) and magically turned this into AAA paper, They will be caught on the low-status back room stuff - the paperwork processing and conveyance of notes and mortgages to the trusts. But I now believe they will be held to account.

And remember: Al Capone was taken down for tax evasion!

Remember: they got Al Capone on tax evasion.

Friday, June 10, 2011

Getting Started - June 10, 2011

I was never a serious student of US history, politics or economics until the runup to the 2008 election. Dreams from My Father had inspired me to follow Barack Obama, and the political scene more broadly. Before I knew it, I was hooked, keeping reasonably good track of the political and economic scene.

My Dad (a very young 95!) has, from time to time, urged me to write a blog. He finally wore my resistance down, and this morning, over coffee, I came up with a list of possible subjects I might address. I am not an expert on any of them, beyond what three years of quite rigorous "paying attention" could bring. My perspective is strongly progressive (my Dad is conservative!); I feel - as I know many others have before me - that now is an amazing time to be alive, that we are on the cusp of important changes, here in the US and beyond. Here is my morning list:

1. Economics: Our Differing Views of How the World Works

2. The Crisis: What Happened and What Can We Learn?

3. Banks, the Foreclosure Mess, and Economic Recovery

4. The Budget Battles and Two Very Different Futures

5. 2012: Are We Really a Center-Right Nation?

6. Healthcare: The ACA and Controlling Costs

7. Energy: Moving to Energy Security and Lower CO2

8. Immigration: Comprehensive Reform

9. Income Inequality: Our Achilles Heel

10. The Arab Spring: The Game Changes for Israel and Iran

11. Lessons from Libya: A Case for Multilateralism

12. Greece, etc: The Case Against Austerity

13. The US and Islam: Necessary and Unnecessary Conflicts

14. Fighting Terrorism: Why Have We Been So Afraid?

15. Obama: Evaluating his Leadership Practices

Other topics will surely arise, and I may never get around to covering each and every subject area listed above. Will try to post at least twice a week, and over time, I may develop a rhythm of more frequent posting. Will try to provide links from insightful analysts that I have encountered on my "student's journey." I remember my high school Latin teacher, Porky Benton, reminding us that the word student had a most honorable heritage, coming from studeo, studere, meaning to be eager. That is indeed how I find myself - eager to see how we and the world will keep turning out. I look forward to thoughts and comments from my readers, going forward. So - tomorrow, I will begin.

Subscribe to:

Posts (Atom)