|

| Italian 10 Year Bond Prices from Zero Hedge |

This chart shows 16 small green ovals showing where the European Central Bank (ECB) intervened in the Italian debt market over the last two weeks, driving bond prices up. There are two larger rectangles showing periods where the ECB was not a buyer, and prices fell off a cliff.

The European issue has come down to this: Will the ECB declare itself to be a committed buyer of European sovereign bonds to ensure yields stay at affordable levels (say 5%), or not. Today, the Central Bank were heavy buyers, focusing on Italian and French debt, and here's what happened ( all charts from Zero Hedge):

The chart shows the trend in yields for the list of bond issues. As you can see, today the ECB drove down Italian and French yields, but left Spain pretty much on its own. If the ECB would commit to this sort of buying at all times, whenever needed, the sovereign bond attacks would end. But will they do it?

The ECB leadership and Germany say no. Occasional serious forays into the market; but no lender of last resort. What happens if they remain ambivalent, sometimes staying on the sidelines and watching prices nosedive (as in the first chart)? Some very smart folks say Italy will default. See this post by Ed Harrison in Naked Capitalism. With debt yields over 7%, Italy cannot dig her way out through fiscal consolidation or belt tightening. She will default. And the list of attendant disasters is long: serial sovereign defaults, partial or total European bank failure, and contagion spreading to the US through our banks' exposure to European sovereign debt and the Credit Default Swaps they have written on European debt. The US banks claim that their CDS positions are well hedged, but what if one of their hedge sources is an AIG equivalent who can't pay? Not a pretty picture.

And as if the pot weren't spicy enough, S&P will release a large number of ratings upgrades in the next week or so, certainly before Christmas. Some serious downgrades are expected, which will roil the already fragile markets. Take a look at the following three charts, looking at systemic risk among the world's Top 30 systemically important financial institutions (here's the list):

The ECB leadership and Germany say no. Occasional serious forays into the market; but no lender of last resort. What happens if they remain ambivalent, sometimes staying on the sidelines and watching prices nosedive (as in the first chart)? Some very smart folks say Italy will default. See this post by Ed Harrison in Naked Capitalism. With debt yields over 7%, Italy cannot dig her way out through fiscal consolidation or belt tightening. She will default. And the list of attendant disasters is long: serial sovereign defaults, partial or total European bank failure, and contagion spreading to the US through our banks' exposure to European sovereign debt and the Credit Default Swaps they have written on European debt. The US banks claim that their CDS positions are well hedged, but what if one of their hedge sources is an AIG equivalent who can't pay? Not a pretty picture.

And as if the pot weren't spicy enough, S&P will release a large number of ratings upgrades in the next week or so, certainly before Christmas. Some serious downgrades are expected, which will roil the already fragile markets. Take a look at the following three charts, looking at systemic risk among the world's Top 30 systemically important financial institutions (here's the list):

You can see we are back in market crash territory (risk is a composite measurement of CDS spreads). Here's a regional breakdown, showing how high up in risk perception the US is:

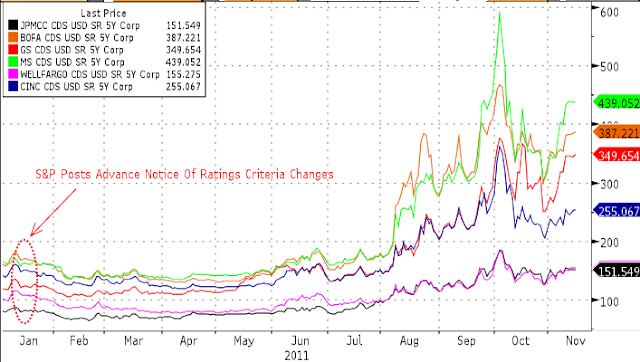

And finally, here are the US majors. Notice that only JP Morgan and Wells Fargo have relatively moderate CDS spreads:

So what do I really think will happen? I think Germany and the ECB will reverse course; but it will take some major market meltdown to make this happen. Even then we may not be out of the woods, because Europe will surely be in recession, and any number of things could cause a true credit event, given the market's deep fragility.

What to do? Hedge, if you can. If you cannot, consider moving more into cash. We are in troubled waters. I do not know exactly how the blows will come. But they are coming.

No comments:

Post a Comment